Small Groups. Big Growth.

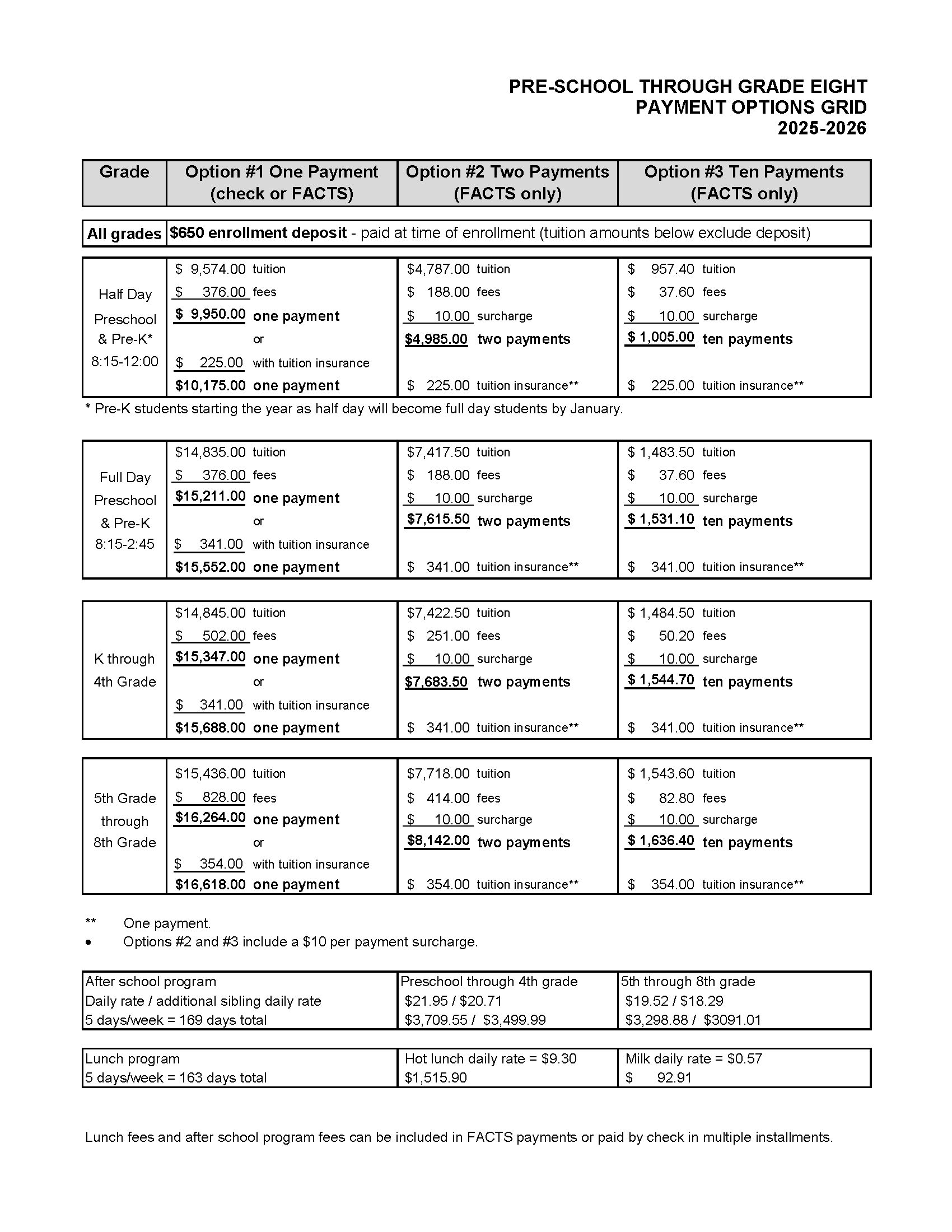

Tuition

Tuition Overview

HALF DAY- Preschool/Pre-kindergarten

Lower School

Grade K- 4th

Full Day- Preschool/Pre-kindergarten

Close-knit Classes

Middle School

Grade 5th-8th

Optional Add Ons and Discounts

After School Program

Daily

Lunch

Daily

Additional Sibling Discounts

After School Program

Preschool-4th Grade

- Daily After School Program- $20.71

- 5 Days/Week After School (169 Days)- $3,709.55

After School Program

5th-8th Grade

- Daily After School Program- $18.29

- 5 Days/Week After School (169 Days)- $3298.88

When a family has three or more students enrolled at Ashbrook full time, the parents are allotted a 30% discount towards the total cost of tuition for their eldest child. Preschool students scheduled to attend both morning and afternoon, five days a week, are considered full time.

Payment Plans and Tuition Insurance

Ashbrook Independent School offers three tuition payment options:

Option #1:

$100 early payment discount :Due by June 30th.

$100 late-fee assessment if paid after June 30th.

Tuition insurance with Dewar Insurance Company is optional but encouraged.

FACTS assesses a $25 annual enrollment fee per payment agreement.

Option #2:

Two equal payments withdrawn electronically from your bank account or credit card in August and

January—managed by FACTS.

FACTS assesses a $25 annual enrollment fee per payment agreement.

Option #3:

Ten equal payments withdrawn electronically from your bank account or credit card beginning

in August—managed by FACTS.

(FACTS assesses a $55 annual enrollment fee per payment agreement.)

FACTS is a tuition management company Ashbrook uses for tuition and other payments.

♦ Required for Options #2 and #3; optional for Option #1.

♦ Set up your online FACTS account authorizing your bank or credit card to transfer the

payments on the prescribed month(s). Be assured that Ashbrook

Independent School holds your bank information in the strictest of confidence.

♦ FACTS online account set-up is part of the enrollment process.

♦ Please note, FACTS assesses a 2.95% processing fee for credit card payments.

Tuition insurance is available for an additional $341/yr

and is required if paying in installments.

Tuition insurance via Dewar is required for Options #2 and #3; it is optional for Option #1.

♦ Payable directly to Ashbrook Independent School.

♦ Must be paid in full; cannot be included in monthly FACTS payments.

♦ Due by August 1st.

At Ashbrook Independent School, we believe that finances should never stand in the way of an extraordinary education. That’s why we offer financial assistance to eligible families. Aid is awarded based on demonstrated need, which is determined through the FACTS Grant & Aid Assessment service. Applying for financial aid is simple, and there is a $40 application fee.

Families applying for financial aid will need to complete an application and submit the necessary

supporting documentation to FACTS Grant & Aid Assessment.

The following supporting documents are required to complete the application process:

- IRS Federal Income Tax Return, including all supporting schedules (the year of the tax return depends on the tax requirements

of your school). If applicant and co-applicant file separately, we require both tax returns for the same tax year. - Copies of all the current year W-2 Wage and Tax Statements for both the applicant and co-applicant.

NOTE: If you are applying before you have received all the current year W-2 Wage and Tax Statements, please submit them

as soon as they become available. - Copies of all supporting tax documents if you have business income/loss from any of the following:

Business – send Schedule C or C-EZ and Form 4562 Depreciation and Amortization

Farm – send Schedule F and Form 4562 Depreciation and Amortization

Rental Property – send Schedule E (page 1)

S-Corporation – send Schedule E (page 2), Form 1120S (5 pages), Schedule K-1 and Form 8825

Partnership – send Schedule E (page 2), Form 1065 (5 pages), Schedule K-1 and Form 8825

Estates and Trusts – send Schedule E (page 2), Form 1041 and Schedule K-1

-

Application fee: an initial one-time fee of $75 per student due at the time of student visit.

-

Enrollment deposit: an annual fee of $650 per student due each year at the time of enrollment for the upcoming school year (applied to tuition).

-

After school program drop-in: $12.18 per hour, rounded to the nearest half hour. (Only as needed)